Energy Performance Certificates (EPCs) and Risk: How Energy Efficiency Affects Property Valuation and Insurance

Listen to the podcast

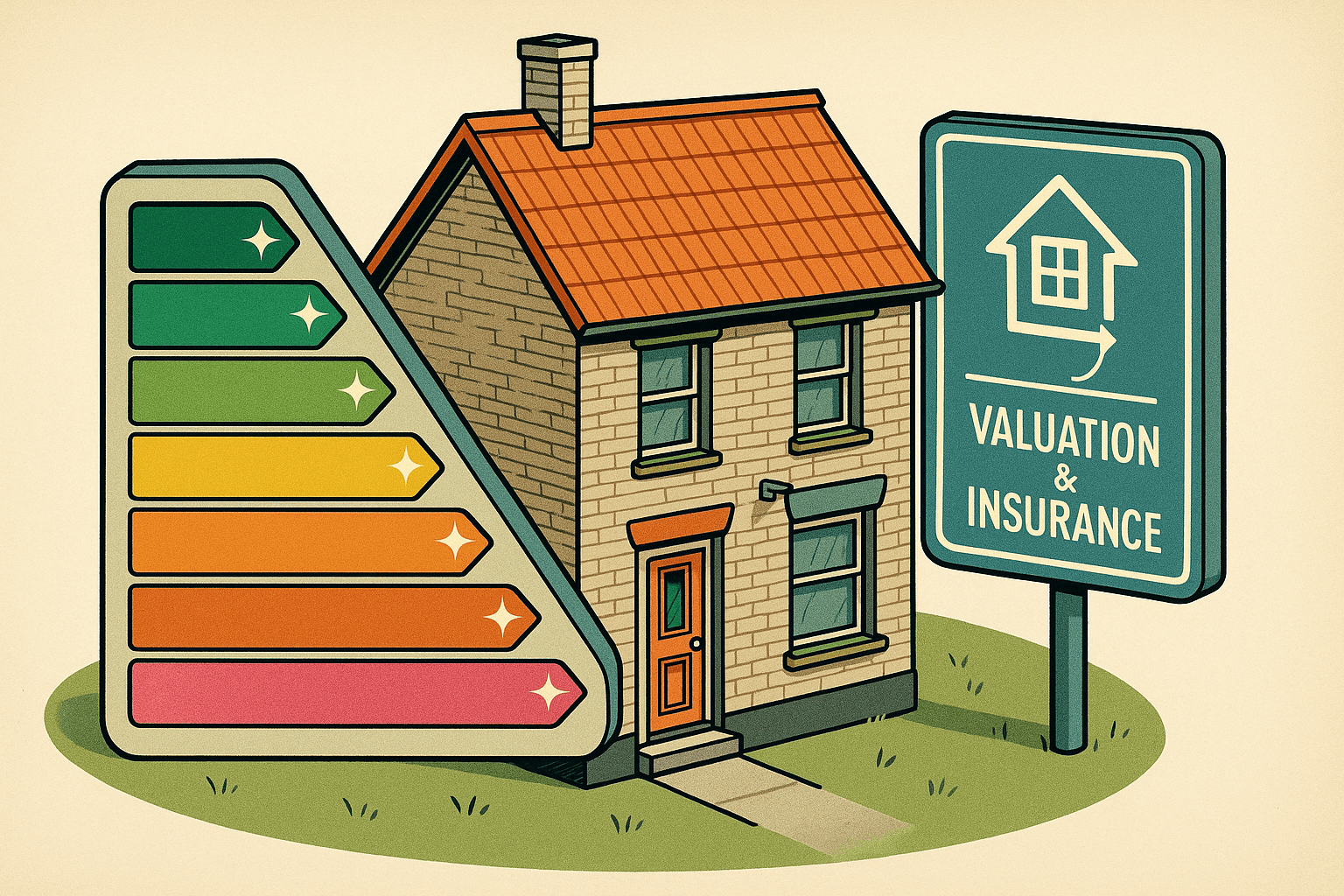

In the contemporary property market, energy efficiency is more than just a selling point; it’s a critical factor influencing property valuation and risk assessment. Energy Performance Certificates (EPCs) provide a standardised measure of a property’s energy efficiency, grading homes on a scale from A (most efficient) to G (least efficient). For insurers and lenders, EPC ratings offer valuable insights into the potential risks and long-term costs associated with a property. By integrating EPC data into their valuation and risk models, insurers and lenders can make more informed decisions, enhancing their pricing strategies and portfolio management.

The Correlation Between EPC Ratings and Property Risks

EPC ratings directly correlate with several risk factors that insurers and lenders must consider. Properties with poor energy efficiency (EPC ratings of E, F, or G) often indicate:

Higher Running Costs: Poorly insulated homes require more energy for heating and cooling, leading to higher utility bills. This can affect a homeowner's overall financial stability, potentially impacting their ability to meet mortgage payments.

Increased Maintenance Needs: Properties with low EPC ratings may have outdated heating systems or inadequate insulation. These characteristics can result in higher maintenance costs and an increased likelihood of claims for issues such as boiler breakdowns or dampness-related damage.

Market Value Vulnerability: In a market increasingly focused on sustainability, properties with low EPC ratings may see their market value decline, especially if stricter regulations on energy efficiency come into play. This can affect the property's resale value and, by extension, the risk profile of loans secured against such assets.

On the other hand, properties with high EPC ratings (A, B, or C) are generally better insulated and equipped with modern, efficient heating systems. These homes tend to have lower energy costs, are less prone to certain types of damage, and often command higher market values. For insurers and lenders, these factors translate into a lower risk profile, influencing everything from premium pricing to loan terms.

How Chimnie’s EPC Data Enhances Risk Assessment and Pricing

Chimnie provides detailed EPC data at the property level, enabling insurers and lenders to incorporate energy efficiency into their risk models. Our data offers insights into each property's current EPC rating, its energy-saving features (e.g., double glazing, solar panels), and potential EPC rating after improvements. By integrating this data, insurers and lenders can:

Refine Risk Models: Incorporate EPC ratings into risk assessments, recognising that properties with higher energy efficiency are less likely to result in claims related to heating failures, damp, or mould.

Tailor Premiums and Loan Terms: Offer more competitive premiums or loan terms for energy-efficient properties, reflecting their lower risk profile and higher market stability.

Identify Opportunities for Risk Mitigation: Highlight properties with potential for energy efficiency improvements, encouraging owners to invest in upgrades that can lower their risk profile and improve their property's value.

.jpeg&w=3840&q=75)

Modern homes usually have a much better energy efficiency than older houses

Case Study: Incorporating EPC Data into Insurance Pricing

Consider an insurer aiming to refine its premium pricing for residential properties. Traditionally, the insurer might rely on factors such as property age, size, and location to assess risk. However, by incorporating Chimnie's EPC data, the insurer can add a new dimension to its risk model.

For properties with poor EPC ratings, the insurer might identify a higher likelihood of claims related to heating system breakdowns or dampness, which can lead to costly repairs. By acknowledging this risk, the insurer can adjust premiums accordingly, ensuring they adequately reflect the potential costs. Conversely, properties with high EPC ratings can be recognised for their lower risk profile, resulting in more competitive premiums that attract energy-conscious homeowners.

This approach not only enhances the accuracy of premium pricing but also promotes a more sustainable housing market. By offering financial incentives for energy-efficient properties, insurers encourage homeowners to invest in energy-saving improvements, ultimately reducing the environmental impact of the housing stock.

The Impact on Mortgage Lending and Property Valuation

Lenders, too, can benefit from integrating EPC data into their risk assessments. Energy-efficient properties are generally more marketable and retain their value better over time. This stability is crucial for lenders, as it reduces the risk associated with mortgage defaults and potential property devaluation.

By incorporating Chimnie's EPC data into their lending criteria, lenders can:

Assess Borrower Risk: Recognise that owners of energy-efficient properties are less likely to face financial strain from high utility costs, reducing the risk of mortgage defaults.

Enhance Portfolio Resilience: Build a more resilient mortgage portfolio by prioritising properties that are likely to maintain or increase in value, particularly as energy efficiency becomes a more prominent market differentiator.

Promote Sustainable Lending: Align with growing regulatory and market pressures to support sustainable, energy-efficient housing. By offering favourable terms for properties with high EPC ratings, lenders can position themselves as forward-thinking and environmentally responsible.

EPC Data and Regulatory Compliance

Beyond market dynamics, regulatory frameworks increasingly emphasise energy efficiency. In the UK, regulations such as the Minimum Energy Efficiency Standards (MEES) mandate that rental properties meet specific EPC standards. This regulatory landscape affects both insurers and lenders, as properties that fail to comply with energy efficiency standards may face market restrictions or legal penalties.

By leveraging Chimnie’s comprehensive EPC data, insurers and lenders can proactively identify properties at risk of non-compliance, adjusting their risk models and pricing strategies to account for potential regulatory impacts. For example, a lender might adjust its loan-to-value ratio for properties with low EPC ratings, reflecting the risk of future market devaluation or regulatory restrictions.

Conclusion: The Strategic Importance of EPC Data

Energy efficiency is no longer a peripheral consideration in property risk assessment. EPC ratings provide a critical measure of a property's risk profile, influencing everything from insurance claims to market value. By integrating Chimnie's detailed EPC data into their risk models, insurers and lenders can enhance their pricing strategies, promote sustainability, and navigate an evolving regulatory landscape.

Chimnie’s EPC data empowers insurers and lenders to move beyond traditional risk models, offering a more holistic approach to property assessment. By recognising the value of energy efficiency, they can not only reduce risk but also contribute to a more sustainable and resilient property market.